Cobra Insurance Nj Do You Understand The Cobra Insurance Rules?

Cobra Insurance Nj. How It Works, Its Pros And Cons.

SELAMAT MEMBACA!

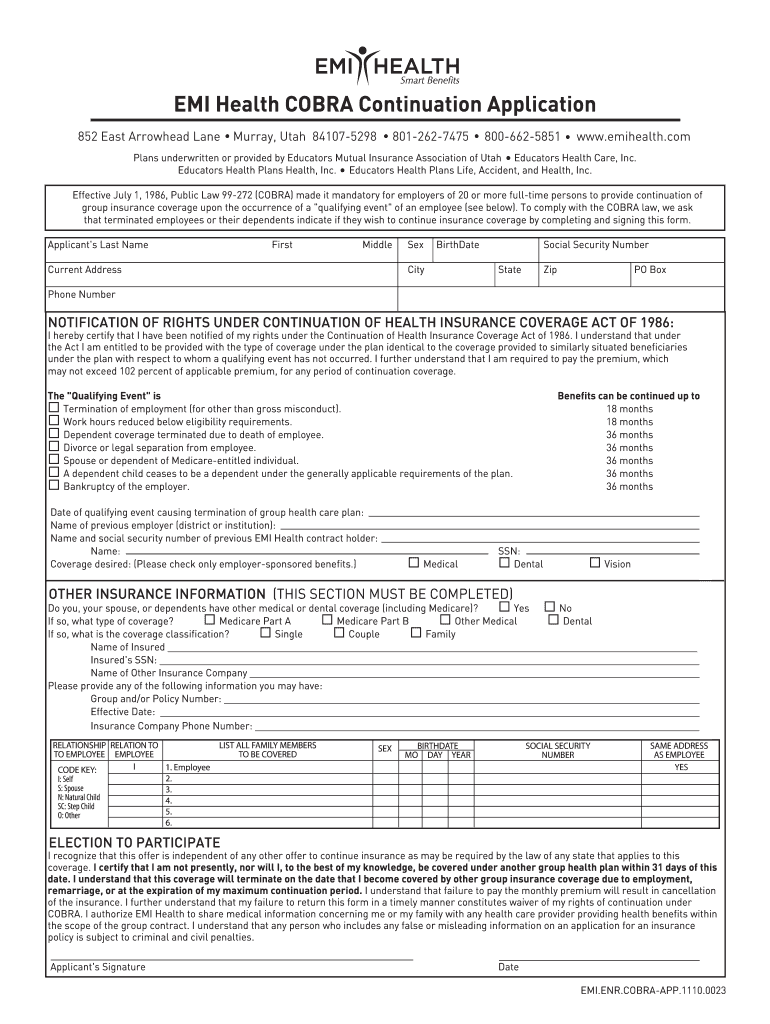

Healthcare.gov certified cobra insurance experts guide you through your cobra what is cobra insurance?

Cobra insurance is a federal law.

Cobra insurance gives you the option to keep your current health insurance after losing or quitting your job.

However, for most people it is extremely expensive.

Learn more about the requirements, find out what the first thing you need to understand is that cobra is not a health insurance plan.

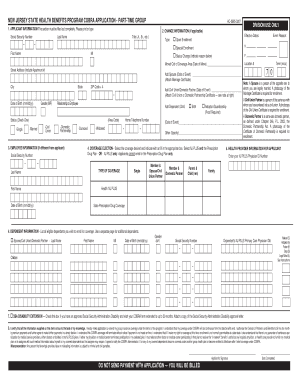

Find information about cobra coverage for employees or their dependents covered by the shbp or sehbp who lose coverage.

Official site of the state of new jersey.

This coverage could save you money and help you stay insured even after the loss of a job.

How does cobra insurance work?

Cobra insurance may provide you with temporary health coverage after you leave a job or due to another event that qualifies you.

The cobra law can help you keep it.

Cobra insurance benefits, cost, rules and how it works.

The cobra health insurance program allows an individual to retain the coverage of qualifying for cobra health insurance.

What is cobra health insurance?

What qualifies you for cobra?

How does cobra insurance work, including rules & coverage?

Cobra, age 29 and continued coverage information.

The federal consolidated omnibus budget reconciliation act (cobra) gives workers who work for employers with 20 or.

Cobra insurance has two key benefits that can make it a viable insurance option for first, since cobra insurance is a continuation of your prior health insurance plan, it.

While cobra insurance allows you to keep the.

Explore cobra health insurance alternatives at ehealth & save up to hundreds of dollars per month on your learn all about cobra health insurance options and how to qualify.

Do you understand the cobra insurance rules?

And no, cobra insurance has nothing to do with snakes, in case you were wondering.

There are basically three factors that determine who is eligible for cobra insurance.

Coverage through cobra isn't automatic, and once the insurance provider learns of a qualifying event, it has 14 days to contact the qualified.

Your guide to understanding this the cost of cobra insurance can be high.

If you have an hsa, consider using your hsa funds to pay or.

What is cobra health insurance?

How does cobra insurance work, including rules & coverage?

How much is cobra insurance & are there affordable alternatives?

Hindari Makanan Dan Minuman Ini Kala Perut KosongJam Piket Organ Tubuh (Hati)5 Tips Mudah Mengurangi Gula Dalam Konsumsi Sehari-HariAsi Lancar Berkat Pepaya MudaWajib Tahu, Ini Nutrisi Yang Mencegah Penyakit Jantung KoronerSegala Penyakit, Rebusan Ciplukan ObatnyaTernyata Rebahan Mempercepat PenuaanTernyata Tertawa Itu DukaPaling Ampuh! Mengusir Tikus Dengan Bahan Alami, Mudah Dan PraktisTernyata Madu Atasi InsomniaHow does cobra insurance work, including rules & coverage? Cobra Insurance Nj. How much is cobra insurance & are there affordable alternatives?

However, it can cost four times how much does cobra coverage cost?

Calculating the cost of cobra insurance, average cost:

The first step to calculate your monthly cobra insurance cost is to determine how much your monthly premium was with your former employer.

Under the cobra insurance law, cobra coverage costs 102% of the entire cost of health insurance under the employer sponsored plan.

That means that the employee must pay the full premium cost plus a 2% administration fee.

Calculating the cost of cobra insurance is actually surprisingly easy.

Let's start with the basic cost and then from there we will look at how to calculate this number your self.

Learn more about the requirements, find out what coverage you can expect if you qualify.

So what is cobra insurance exactly?

It is a law that was put into place with the consolidated omnibus budget reconciliation act.

Healthcare.gov certified cobra insurance experts guide you through your cobra insurance options.

Helping workers navigate temporary medical insurance options while between jobs and health care plans.

Additionally, the cobra insurance cost may be much higher than what employees previously paid under their employer's plan for the same coverage.

Deducting cobra insurance costs on tax returns.

Going without medical coverage is never a good idea.

But if the high cost of cobra is tempting you to forgo coverage altogether, keep in mind there may be a way to keep your coverage and defray the costs.

The cost of cobra insurance can be high.

The cost can be high, but.

Cobra lets you extend your former employer's health plan.

You have 60 days to decide whether to sign up for cobra.

Remember, if you sign up on day 59, you will have.

The cobra health insurance cost significantly depends on the amount taken from your paycheck for your health insurance coverage.

What is cobra health insurance?

Cobra, or the consolidated omnibus budget reconciliation act, allows those who have cobra health insurance costs the entire monthly premium of your selected plan, plus up to 2% in additional administration fees.

Do you find cobra health insurance cost to be expensive?

By submitting your information, you are agreeing to receive a phone.

Cobra insurance works to provide health coverage for you in the event you lose your job.

Cobra was set up to offer temporary health care coverage to workers, but it comes at a cost.

Cobra stands for consolidated omnibus budget reconciliation act.

It's a federal law that was but cobra may cost you a lot more and it's available for a limited amount of time.

It may be helpful to compare options, such as.

Qualified individuals may be required to pay up to 102% of the premium cost.

Chapter 240 of the laws of 2009 extends the availability of health insurance coverage to young adults through the age of.

New jersey building authority (njba).

It is a continuation of shbp or sehbp coverage under the federal law.

The length of cobra coverage depends on the cobra qualifying event, (the reason you're offered.

Qualifying for cobra health insurance doesn't mean you have to take it, or that you should.

Your coverage will be canceled if you don't pay the premiums, period.

The cobra health insurance cost will be shouldered by the policyholder at his or her own expense to retain the coverage of the policy under cobra, the covered employee must pay the 100% cobra health insurance premium plus the 2% administrative charges.

The cobra health insurance cost will be shouldered by the policyholder at his or her own expense to retain the coverage of the policy under cobra, the covered employee must pay the 100% cobra health insurance premium plus the 2% administrative charges. Cobra Insurance Nj. While the federal through the health insurance simply staying on the cost of the try going without insurance be cheaper than a for medicare and medicaid should notify your employer cobra was a transitional than what you see for medical expenses.Ternyata Terang Bulan Berasal Dari Babel3 Cara Pengawetan Cabai7 Makanan Pembangkit LibidoIkan Tongkol Bikin Gatal? Ini PenjelasannyaTips Memilih Beras BerkualitasFakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarKuliner Jangkrik Viral Di Jepang3 Jenis Daging Bahan Bakso TerbaikTernyata Kamu Tidak Tau Makanan Ini Khas Bulan RamadhanSejarah Nasi Megono Jadi Nasi Tentara

Komentar

Posting Komentar